Oil has been the vital resource in the global economy since internal combustion engine arrived in human civilization in the 1800s. Numerous wars and global economy turmoil were caused by this resource. Oil fuels most of the world’s transportations like cars, ships, and planes. But as the time goes by, humanity discovered that utilizing oil can cause environmental changes that is threatening to every living being – climate change. Climate change has been the focus of the world in the recent times. Many governments have made commitment to reach net zero carbon in an effort to mitigate the effect of climate change. Many includes replacing oil with renewable energy and electricity as part of their policies to fuel vehicles and generate power. the question is will the era of oil be over?

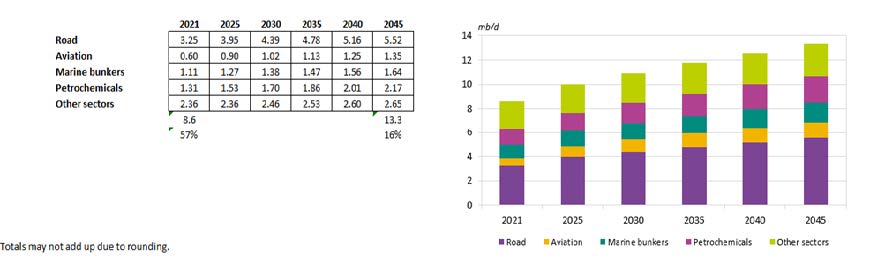

Though one can argue that oil will remain as a significant source of fuel in the coming decades, we should not overlook on other sectors that oil is used. From 2022 World Oil Outlook report issued by the OPEC, 57% of oil demand in the rest of Asia (Asia excluding China and India) region are driven by the transportation sector (road, sea, and air) as expected. But the next most consuming sector is also a very close to our lives, Petrochemical. Chemicals are another irreplaceable part of modern society. Hard to see our daily lives without plastics, rubber, synthetic textiles, and fertilizers. Petrochemicals are a subset of industrial chemicals derived from petroleum or oil. Petrochemicals account for 90% of total feedstock demand in chemical production by 2018. Their demands are driven by the consumption of plastics, synthetic fibers and rubber. Petrochemical is expected to account for mare than a third of the growth in oil demand to 2030 and nearly half the growth to 2050.

Exhibit 1: Oil demand in ‘Other Asia’ by sector, 2021-2045

(mb/d)

Source: OPEC

In Indonesia, the chemical industry is the top three contributors to the performance of the non-oil and gas processing industry and a significant driver of economic growth. Indonesian export value of chemicals and chemical goods reached USD 18.86 billion in 2021. Looking at the contribution and future potential of the sector, Indonesian government has targeted to be the largest petrochemical producer in ASEAN. For 2020 to 2030, Indonesian government is trying to oversee the construction projects of the giant chemical industry with a total investment value of USD31 billion. State Owned Enterprise (SOE) has been the major tool for Indonesian government to implement its policies. As one of the, if not, largest SOE in the oil sector, does Pertamina has enough initiatives and resources to be able to ride into the waves and capture the future potential of petrochemical industry?

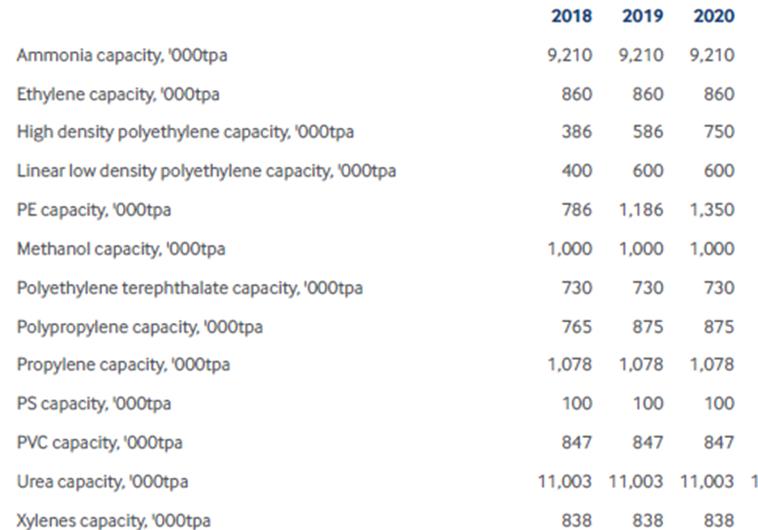

Being an agriculturally dominated economy, Indonesian petrochemical industry was dominated by fertilizer production up to the late 1980s. After that, Indonesia started to produce a wider range of petrochemical products. As of 2020, Fitch Solutions recorded that Indonesia at least have capacities to produce 13 major types of petrochemicals such as methanol, benzene, polystyrene, polyethylene, and goods used for fertilizers such as Urea and Ammonia.

Table 1: Indonesia – Petrochemicals Sector Capacities, Historical Data and Forecast

Source: Fitch Solutions

Indonesian petrochemical market is already consolidated with several major players. Chandra Asri Petrochemicals (CAP) has been the sole ethylene producer of Indonesia. the company has its petrochemicals profits put under pressure due to rising feedstock costs and a lack of economies of scale. Specifically producing petrochemicals for the fertilizer sectors is the subsidiary of Indonesian largest fertilizer SOE’s, PT Pupuk Sriwijaya (Pusri). Pusri have plants with producing capacity of 660 thousand tons of Ammonia and 908 thousand tons of Urea per year since 2017. Major companies from abroad such as South Korean Lotte Chemical also started to enter the Indonesian market. In October 2021, the company announced that it would build a 1 million tons per year ethylene plant in Cilegon. The construction is estimated to cost USD 3 to 4 billion and scheduled to be completed in 2025.

Indonesia still heavily reliant on the import of raw materials to support its petrochemical industry. Most of the locally produced polypropylene and polyethylene resins are used in food packaging. But local plastic producers face intense competition caused by duty-free imports of semi-finished and finished plastic products which mostly comes from China. Polyolefins imported from ASEAN countries have been non-duty since 2010 due to the ASEAN free trade agreement. This haven’t been working well for local producers which produced more expensive goods as they are dependent on raw material imports. Despite being one of the world’s key natural gas producers, fertilizer plants in Indonesia are struggling to acquire supply of natural gas. As the result, fertilizers are in short supply in the country. The problem Indonesia faced is that natural gas has not been generally available as petrochemical feedstocks because they have been routed to the export sector.

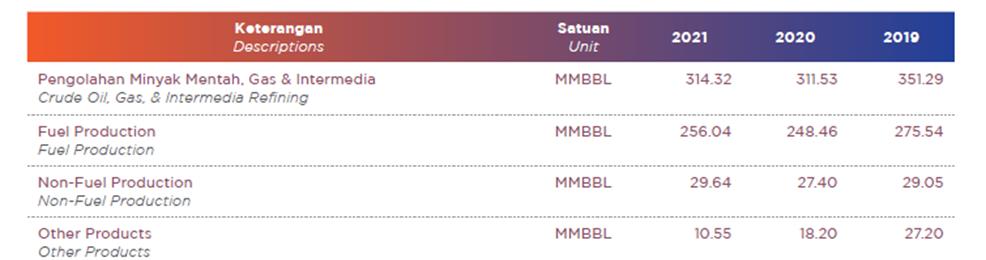

As a player who has access directly to the main raw materials in producing petrochemicals and as an SOE who serve as a tool to implement government’s policies and initiative, Indonesian National Oil Company (NOC), Pertamina is expected to play a major role in the Indonesian petrochemical industry. From its 2021 annual report, its refining and petrochemical segment produced 314.32 MMBBL of crude oil, gas, and intermediate refining, fuel production reached 256.04 MMBBL, nonfuel production reached 29.64 MMBBL, and other products reached 10.55 MMBL. It manages its petrochemical business segment through its several subsidiaries which includes PT Tuban Petrochemical Industries (TPI) and PT Trans Pacific Petrochemical Indotama. Pertamina also has plans to increase its petrochemical production to 8.6 million metric tons per year by 2027. This move is expected to attract more investors in Pertamina’s refinery projects. To achieve it, Pertamina has done several cooperation with major players such as Taiwan’s national oil company, CPC. Both companies signed a head of agreement in June 2020 to develop a USD 8 bn complex with a 1.0mtpa cracker due to start commercial operations in 2026. Pertamina will also develop Tuban refinery, that would feed a cracker with capacities of 1.0mtpa ethylene as well as 1.3mtpa of aromatics capacity with Russia’s Rosneft.

Table 2: Ikhtisar Kinerja Segmen Refining and Petrochemical

But building just capacities alone aren’t enough. CO2 emissions from the chemical sector are approximately 1.5 gigatons of carbon dioxide (GtCO2) per year globally, or 18% of industrial CO2 emissions. With all the focus on the sustainability and climate change in the recent decades, Pertamina has to take into account the sustainability of its petrochemical operations. Most importantly as Indonesian government also has the target to become carbon neutral in 2060. And of course, being the tool of government on implementing policies and improve the country’s economy, any Pertamina’s development is hoped to provide employment or additional investments. For this, the company might be able to take a note or two from others development.

Saudi Arabia’s NOC, Saudi Aramco has partnered with French oil giant TotalEnergies to build a petrochemical facility in Saudi Arabia with an estimated investment of around $11 billion. the complex facility is also a part for both companies on expanding sustainably in petrochemicals. The target is hoped to be achieved by maximizing the synergies within both companies major platforms. The ‘Amiral’ complex will be owned, operated, and integrated with the existing SATORP refinery located in Jubail on Saudi Arabia’s eastern coast. SATORP was the first MENA refinery to be certified ISCC+, an international recognition towards its circular initiatives, such as the recycling of plastic and used cooking oil. The first batch of recycled plastic was processed by the refinery in November 2022. The complex will provide feedstock to other petrochemical and specialty chemical plants, located in the Jubail industrial area, which will be built, owned and operated by globally renowned downstream investors, entailing an estimated additional $4 billion of investments. This will support the establishment of key manufacturing industries such as carbon fibers, lubes, drilling fluids, detergents, food additives, automotive parts and tires. The overall complex, including adjacent facilities, is expected to create 7,000 local direct and indirect jobs.

Indonesian’s closer neighbor is also having a similar development plan in mind. Malaysian NOC, Petronas, is developing its largest downstream greenfield development, The Pengerang Integrated Complex. Designed with sustainability in mind, the USD27 billion, 6,303-acre Pengerang Integrated Complex (PIC) is anticipated to lead PETRONAS’ charge towards its net zero carbon emissions (NZCE) 2050 aspirations upon its start up. The complex took on several initiatives to achieve its sustainability targets. Phase 1 of solar project in the complex will install rooftop and ground mounted solar panels, totaling in 49 MWp in capacity. this initiative is estimated to reduce CO2 emissions by over 23,000 tons annually. The complex is powered by what it claims to be the largest and most efficient power plant in the region – Pengerang

Cogeneration Plan (PCP) that is fueled by natural gas. The PCP’s design incorporates Heat Recovery Steam Generators that extract waste heat from exhaust gas to generate steam for process purposes and to power steam turbines, contributing about 1.3 million tonnes per year in CO2 emissions avoidance. In the Residue Fluid Catalytic Cracker (RFCC), the CO Boilers transform waste heat into steam for process heating and to power turbines. The regeneration of RFCC catalyst produces a lot of hot flue gases and these convert boiler feed water into superheated steam for process use. This feature trims CO2 emissions by over 1.3 million tonnes per year. Pengerang Integrated Complex is expected to trim Scope 1 emissions by 3.6 million tonnes, and enabling a reduction in carbon dioxide equivalent (CO2e) emissions by 26 per cent to 10.2 million tonnes annually.

While oil demands for transportation will remain as the major driver of oil consumptions in the following decades, petrochemical will be an industry that is way too attractive to be left behind. With major dependency in import signals for opportunities in the sector, Pertamina can be sure that expansion in the sector will not go unrewarded. As the Indonesian government doesn’t only have more initiative on electrifying vehicles but also expanding its petrochemical industry, Pertamina already has a clear vision on what sector to focus on surviving as an oil company in the future. But on its way, it also has to consider on to ensure its expansion will remain sustainable either commercially or environmentally.