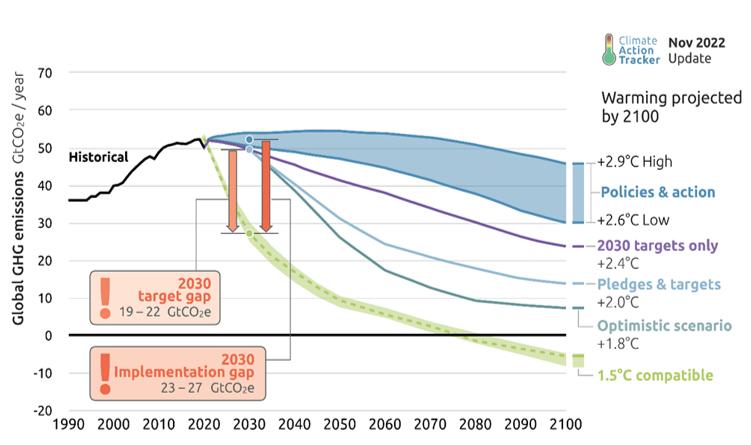

Net-zero carbon, sustainability, green energies, all have been becoming an inescapable topic for everyone in the recent decade. From countries’ governments, companies, to individuals, all have been racing to come up with a better way to change how our economies and life work with hopes to prevent more catastrophic effect of climate change. Countries around the world have grouped together to combine efforts to maintain global warming in year 2100 to 1.50C over pre-industrial level. current policies and action projection from Climate Action Tracker still saw a large gap in the efforts, projecting that with current targets policies and actions, we will end up with 2.70C global warming by 2100. As we begun to feel the climate change effects even more, efforts to step-up the sustainability related policies have been increasing globally.

Emissions and expected warming based on pledges and current policies

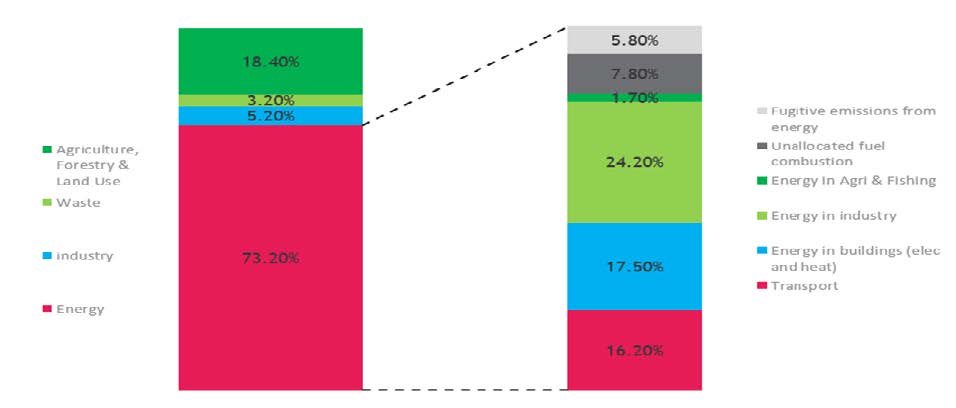

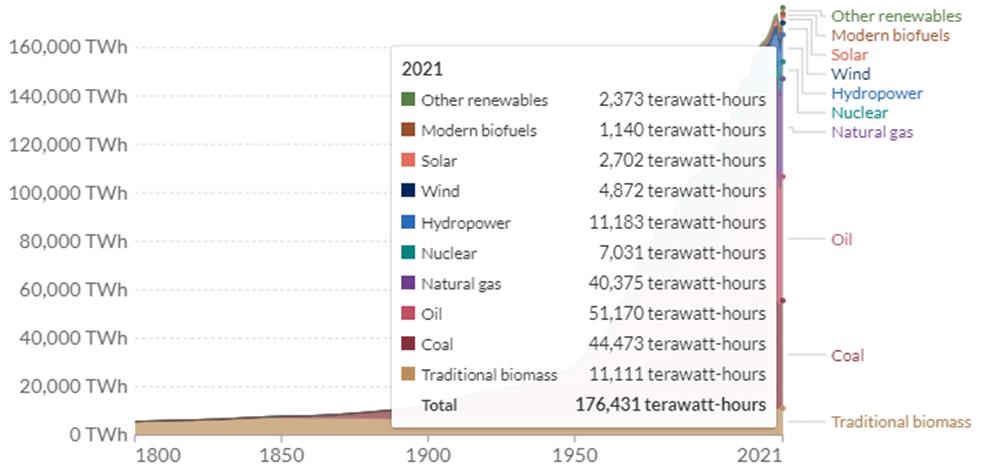

One of the major spotlight areas for such policies is the energy sector, the closest to our daily lives. By 2020, energy contributes up to 73.2% of global greenhouse gas (GHG) emissions, and the sub-sector of energy use in buildings and industries making up 43.4% of global GHG emissions. Changing how we produce our energy would have a major significant effect. As of

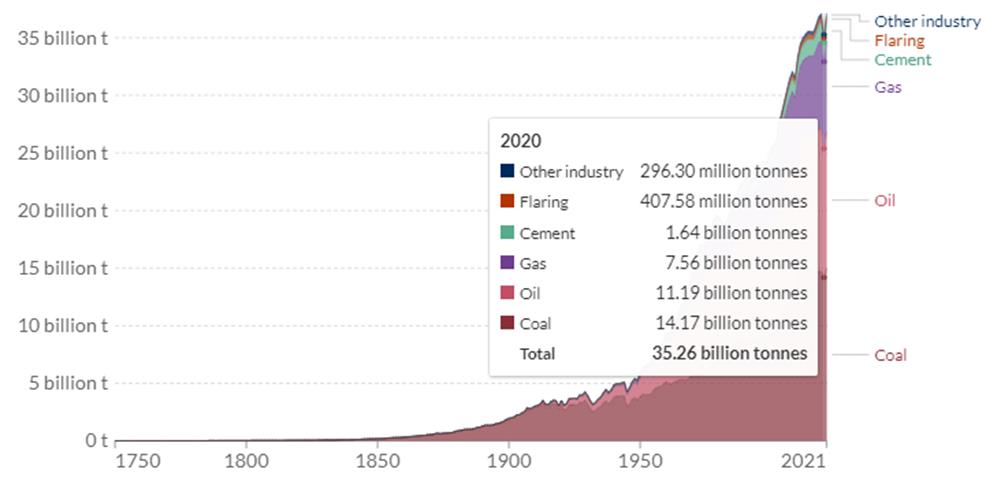

2021, around 25% of global energy are sourced from coal, one of the dirtiest sources of energy, which contributes 40% of global CO2 emission or 14.98 Billion tons. 23 countries have made commitments in 2021 United Nations Climate Change Conference or COP 26, to phase out coal power and scaling up clean renewable energy power to ensure the transition. Indonesia as one of the countries on making the commitment, preparing itself to implement the supporting policies and initiatives. But as one of the economies which relies quite significantly on coal, will it be ready for the effect of the shifts?

Primary energy is calculated based on the ‘subtitution method’ which takes account the inefficiencies in fossil fuel production by converting non-fossil energy into the energy inputs required if they had the same conversion losses as fossil fuels.

Source: Our World in Data based on Vaclav Smil (2017) and BP Statistical Review of World Energy

Source: Our World in Data based on the Global Carbon Project (2022)

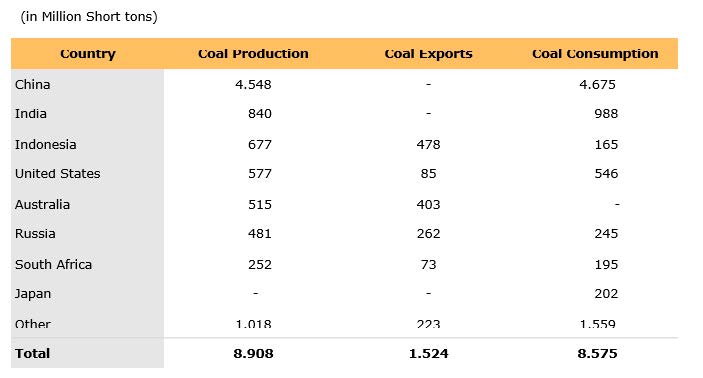

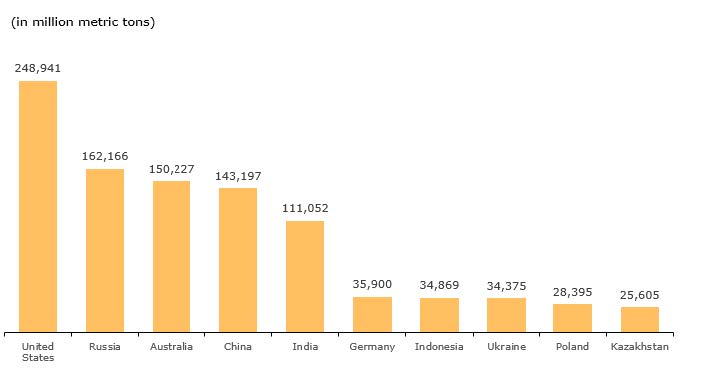

Coal has been a major part of the Indonesian economy. Indonesia holds the 7th largest proven coal reserve in the world by 2020, amounting to 34.8 billion metric tons. But Indonesia proves to be the major coal producer and exporter on the global level, ranked 3rd and 1st respectively in 2021. Indonesian revenue from the mineral and coal mining sector (Minerba) recorded a figure of IDR 124.4 trillion in 2021, which is the highest in the last 5 years. Indonesia also ranked 8th globally on coal consumption, by consuming 165 million tons of coal.

Source: National Mining Association “EIA World Coal Production, Trade and Consumption 2021”

Source: BP Statistical Review of World Energy 2021, page 46

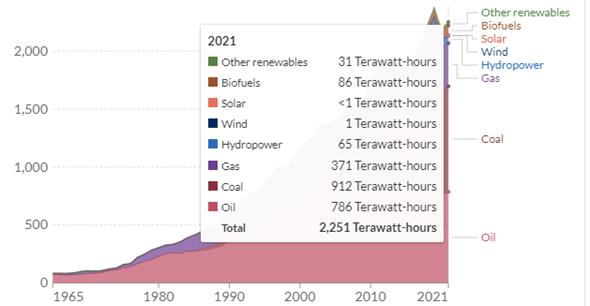

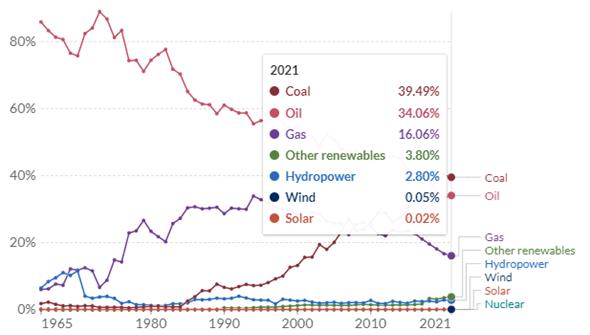

Indonesian energy consumption from coal keeps increasing since 1990. By then, 40 terawatt-hours were produced from coal, comparing it with the 2021 number of 912 terawatt-hours. Dependency of coal also increased over the same period. In 1990, only 6% of Indonesian energy mix was sourced from coal, ranked 3rd after oil (61%) and gas (28%). By 2021, coal even

becoming the main energy source mix, where it contributes 39%, beating oil and gas which reached 34% and 16% respectively. Of course, this in turn made coal as the main source of CO2, producing 303.15 million tons out of total 609.79 million tons or 48% of Indonesian CO2 emission in 2021. Looking at such contribution to the economy, phasing out coal energy in Indonesia would be a great challenge to say the least.

Primary energy consumption is measured in terawatt-hours (TWh). Here and inefficiency factor (the ‘subtitution’ method) has been applied for fossil fuels, meaning the shares by each energy source give a better approximation of final energy consumption.

Primary energy consumption is measured in terawatt-hours (TWh). Here and inefficiency factor (the ‘subtitution’ method) has been applied for fossil fuels, meaning the shares by each energy source give a better approximation of final energy consumption.

To convert from primary direct energy consumption, an inefficiency factor has been applied for fossil fuels (i.e. the “subtitution method’)

Source: Our World in Data based on BP Statistical Review of World Energy (2022)

Indonesian government has formally prohibited new construction of coal powered steam power plant (PLTU) since September 2022 by issuing the Presidential Regulation No. 112 of 2022 concerning the Acceleration of Renewable Energy Development for the Supply of Electricity. The regulation was issued in order to support Indonesian government policy to reach carbon neutrality by 2060. Before that, in 2021, Indonesian national electricity utility company, PLN, has already prepared plans to retire coal and gas-combined cycle powered power plants, or PLTU and PLTMG other than prohibiting new such power plant types by 2025. The company is prepared to retire up to 50.1 Gigawatt of such power plants by phases from 2030. The plans are PLN will stop the operation of the first phase of the first subcritical PLTU with a capacity of 1 GW in 2030. Then, PLN will stop the second phase of the subcritical PLTU with a capacity of 9 GW in 2035. Then in 2040, it will continue for the retirement of the third phase of the subcritical PLTU with a capacity of up to 10 GW. Furthermore, the fourth stage with power reaching 24 GW in 2045 and the termination of the 5 GW ultra- supercritical PLTU in 2055.

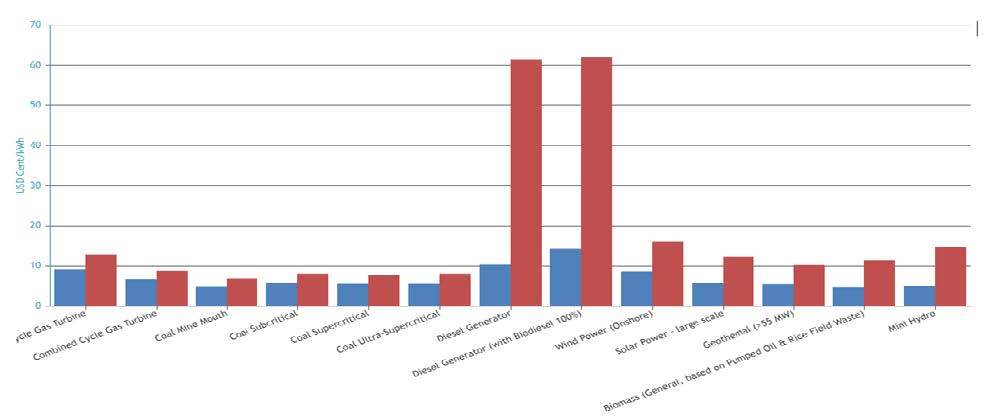

Such plans do require implementation in phases because it would have significant effects to the Indonesian economy as there are much need to be prepared. At least there are three things that Indonesia has to focus on. First thing is for Indonesia to prepare to ensure the power transition

happens smoothly is the availability of other alternative energy sources, and to make sure it is financially feasible. Institute for Essential Service Reform or IESR, provided calculation which shown that renewable energies levelized energy cost in Indonesia have been close to the cost from coal power. But renewable energies unreliable nature usually requires additional investment to support its operation. For example, as solar power only available during daylight, investment for energy storage is required to ensure electricity is also available during nighttime. Indonesian government must take more steps to incentivize power producer to invest in renewable energies in hope to reduce the cost of electricity and making it attractive to use renewable energies.

For the second part, Indonesia would also need to secure financial supports from other countries. As developed countries had the opportunity to develop their economies earlier with fossil fuel energies, it would be fair for them to support developing countries like Indonesia who must immediately switch to renewable energies which have higher costs. Speeding up coal power transition will require a significant amount of financial support for various needs such as buying the coal assets and winding them down, and ensure electricity remains affordable when it switches to renewables. Finance Minister Sri Mulyani stated that Indonesia will need USD 10 to 23 billion to in “implicit subsidies” for renewable power projects until 2030.

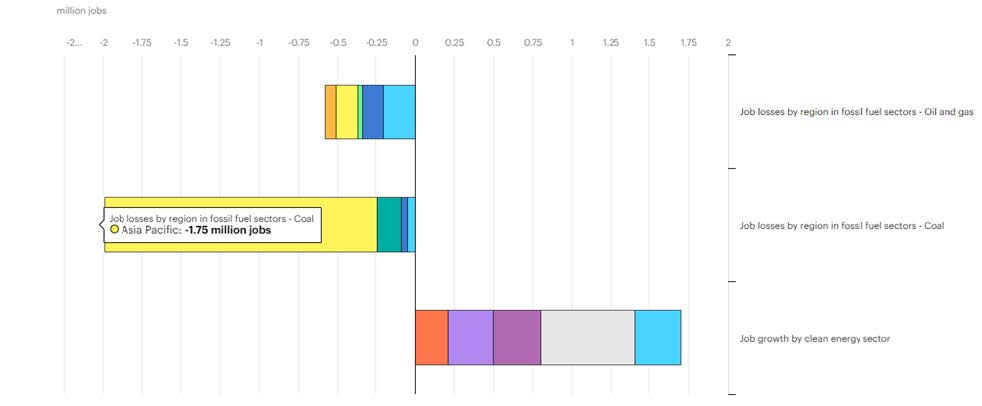

On the third, Indonesia must prepare itself for the effect of coal phase out in the job employment market. Phasing out coal power does not only affect employment in the power sector itself, but also affect the employment in the mining sector, as it will signify declining demand for coal itself. In 2019, there are 150,000 people employed in the coal related sector, with 0.1% of the employment attributed to foreign workforce. That number doesn’t include people who are working in the coal power plants, which in turn will result in higher number of job loss. Though renewable energies will also provide new employment, most of the workforce in the coal sector are unskilled, making it improbable for them to switch easily to renewable energies without significant trainings and educations. International Energy Agency or IEA projected a large job loss in the Asia Pacific region as the effect of coal phase out, with less opportunities available in the renewable sector. A proper policy to ensure job opportunitiesfor the current labor in the coal related sector is a must for the Indonesian government.

Coal phase out is still on the early level in the international level due to our heavy reliance on the resource. Among G20 countries for example, only five have a full coal phase out target which are Canada, France, Germany, Italy, and the United Kingdom. By 2021, only three countries completed the coal phase out, Austria, Belgium, and Sweden. The mentioned countries and others in progress have variety of tools to help accelerate coal phase out. From there, several examples may proof to be a good reference for Indonesian government’s next initiatives.

Air Pollution regulation could serve as a tool to retire coal power plants faster. As coal power plants are major source of air pollution, introducing more strict requirements on pollutants such as fine particulate matter, nitrogen oxides, and sulfur oxides will have significant effect on operating costs and investment. Additional investment for advanced technologies on air filtration will be required to continue operating coal power plants, making it more unattractive for investors. European Union and United States have introduced stringent standards which resulted in massive retirement of coal power plants.

Germany introduced compensation for power companies that closed their coal power plants before the end of their economic or technical life. The support is provided in form of payments with agreed dates for closure.

Subsidies and other fiscal regulatory mechanism provided by United Kingdom government are also used to promote renewable energy and converting coal power plants. Drax coal power plants in the country is supported by contract for difference (CfD) where government would cover for price differences after converting four units in the plant to burn biomass instead of coal.

More policies and measures for coal phase out are being implemented in the recent times. This means more alternatives and examples where Indonesian government could use to phase out its dependency on coal. But each policy and tools will have its own risk and effects to the economy which have been heavily depended on coal to turn its wheel. More likely, Indonesia will face problems on its way to phase out coal from its economy. Reduction of country’s revenue, higher cost of electricity, and unemployment will be expected at least in certain level. Nevertheless, phasing out coal power is a must. But like doctors said when they are injecting their patients with needles to cure them, the coal phase out may hurt and it will get worse before it gets better.